Experts predict a big jump in gold prices by 2025, with an average of $2,600 per ounce. This follows a big rise in 2024, where gold prices went past $2,400. This was earlier and more dramatic than expected.

Gold’s strong case is still there, thanks to many factors coming together. These include growing global tensions and changes in Federal Reserve policies. Also, there’s more buying from central banks and a possible increase in investor interest. All these point to gold’s bright future.

Key Takeaways

- Gold prices are predicted to reach an average of $2,500 per ounce in the fourth quarter of 2024 and climb to $2,600 per ounce in 2025.

- Factors driving the gold price boom include geopolitical risks, a potential Federal Reserve interest rate cutting cycle, and continued central bank buying of gold.

- Inflation is expected to moderate, with U.S. core inflation forecast to reach 3.5% in 2024 and 2.6% in 2025, supporting the case for gold as an inflation hedge.

- The mining industry and supply dynamics will play a crucial role in shaping the gold market and price movements in the coming years.

- Historical gold price analysis and market speculation suggest the potential for further significant gains in the precious metal’s value.

Key Factors Driving Gold Prices Higher in 2024

Gold prices have hit record highs of $2,409 per ounce in 2024. This rise is due to several factors. Key among these are geopolitical risks and the safe-haven demand for gold, and the Federal Reserve’s interest rate outlook.

Geopolitical Risks and Safe-Haven Demand

When the economy and politics are uncertain, investors look to gold. It’s seen as a safe-haven asset and an inflation hedge. The ongoing tensions and global instability have made gold more popular. Investors are turning to gold as a safe choice.

Federal Reserve Interest Rate Outlook

The Federal Reserve’s interest rate outlook has also pushed gold prices up. Expectations of rate cuts in 2024 have made gold more appealing. With lower interest rates, gold becomes a more attractive investment.

Central bank gold purchases from countries like China, India, and Turkey have boosted gold demand. This robust central bank buying has strengthened the gold market. It shows gold’s strategic importance in the global financial system.

Gold’s ability to stand strong in a volatile world has made it key for investors. It’s seen as a crucial part of a well-rounded investment plan. Gold offers both traditional benefits and the chance for big returns in today’s market.

Decoupling from Real Yields and Fed Rate Cuts

Gold prices have seen a surprising rise, showing a decoupling from real yields. This is interesting because it happened even as the decoupling and federal reserve interest rate outlook suggested rate cuts and higher U.S. real yields. This is due to strong labor and inflation data.

Gold usually moves with U.S. real yields. But in 2024, this link broke. This means gold’s rise is not just about real yields or federal reserve interest rate outlook.

“The expectation is that the dollar should stay strong or get stronger from current levels, as it yields more than half of the currencies globally.”

The federal reserve interest rate outlook also matters. Central banks might cut rates, leading to lower yields and less carry trade. This has helped gold break away from real yields.

Gold has done well despite economic uncertainty, hitting new highs. As the market deals with many economic factors, watching how gold relates to real yields and federal reserve interest rate outlook will be key to its future.

Central Bank Buying and ETF Flows Supporting Demand

Central banks have boosted gold prices in 2023 and will likely do so in 2024 too. China led the charge, buying 1,037 tonnes of gold in 2023. The first three months of 2024 saw 290 tonnes added, making it one of the top buying quarters since 2022.

Robust Central Bank Gold Purchases

Central banks buying a lot of gold has helped keep its prices high. The central bank gold reserves have hit new highs. The Reserve Bank of India, for example, bought 9.3 tonnes of gold in June 2024, more than its usual monthly amount. This has pushed its gold reserves to a record 840.7 tonnes, making up 8.7% of its foreign reserves, up from 7.4% last year.

Potential for ETF Inflows as Cutting Cycle Begins

Not just central banks, but also investors are showing more interest in physical gold and ETFs. This is likely to help gold prices go up as the U.S. Federal Reserve starts cutting rates. Europe and Asia have seen more money flowing into gold ETFs, with North America seeing less. This trend is expected to continue, making gold a safe choice for investors, which will help keep gold prices high.

With strong central bank gold reserves and growing ETF flows, gold prices are likely to stay strong. This looks like it will lead to more growth in gold prices in 2024 and the years after.

Gold Price Boom Prediction in 2025

The global economy is facing uncertain times, making the gold market look promising. Big names like J.P. Morgan see a strong future for gold. They’ve raised their price targets for this precious metal.

JPMorgan’s Upgraded Price Targets

J.P. Morgan Research thinks gold prices will hit an amazing $2,500 per ounce by the end of. This is based on a Fed cut starting in November 2024. It could push gold to all-time highs.

They also predict an average price of $2,500 per ounce in the fourth quarter of 2024. And a stunning $2,600 per ounce in 2025. There’s even a chance for an early spike.

Average Price Forecast for Q4 2024 and 2025

Many experts see gold trading between $2,421.00 and $2,651.00 in 2024. Some predict a range of $2,000.00–$2,133.00. Others think it could go as high as $2,750.23–$2,810.76 per ounce.

For 2025, LongForecast expects a jump to $2,799.00. Experts predict a swing between $2,441.00–$2,882.00 in early 2026. By year’s end, they see a drop to $2,566.00 per ounce.

Coin Price Forecast sees gold reaching $4,649.00 per ounce by 2030. Yet, some predict a more modest increase to $2,800.00.

With gold’s strong outlook, investors and traders will keep a close eye on its performance. They’re excited to see what the future holds for this precious metal.

Economic Factors Influencing Gold Prices

Gold prices change due to many economic factors. Inflation and real yield dynamics are key. As inflation goes up in big economies like the U.S. and EU, people turn to gold to keep their money safe. This makes gold prices go up.

Central banks’ interest rate policies affect gold prices too. Low interest rates make gold more appealing than bonds or savings accounts. But high interest rates make gold less attractive, as people prefer assets that earn interest.

The strength of the U.S. dollar also changes gold prices. A weak dollar makes gold cheaper for investors worldwide, boosting demand and prices. But a strong dollar makes gold pricier for investors using other currencies, lowering demand.

| Economic Factor | Impact on Gold Prices |

|---|---|

| Inflation | Higher inflation rates drive up gold prices as investors seek to protect their purchasing power |

| Interest Rates | Lower interest rates make gold more attractive, while higher rates can make it less appealing |

| U.S. Dollar Strength | A weaker dollar makes gold cheaper for investors holding other currencies, increasing demand |

Knowing these economic factors helps investors and analysts guess gold prices and make smart investment choices.

gold price boom predication in 2025

The gold price is expected to rise in 2025 due to several factors. These include the ongoing economic recovery from the COVID-19 pandemic, inflation worries, and central bank policies. If interest rates stay low to boost growth, gold might become more popular as a protection against inflation. Also, geopolitical tensions could push investors towards safe assets like gold.

But, there are risks that could limit gold’s price increase. These include a strong global economy, rising stock markets, and new tech or changes in what investors prefer. The balance between these factors will affect gold prices in the future.

Central Bank Policies and Inflation Dynamics

What central banks, like the Federal Reserve, do will greatly impact gold. If they keep easy money policies to help the economy grow, gold prices might go up. But, if they start tightening policies with higher interest rates, gold prices could fall.

Inflation and real yields also matter a lot. If inflation stays high, gold could see a price jump as investors seek safety. But, if real yields increase because of higher interest rates and less inflation, gold might not look as good compared to other investments.

| Forecast | Target Price | Timeline |

|---|---|---|

| Robert Kiyosaki | $3,700 per ounce | 2024 |

| Jim Rickards | $15,000 per ounce | 2026 |

| Wells Fargo | $2,200 per ounce | 2024 |

| Peter Schiff | $5,000 per ounce | 2024 |

| Bloomberg Intelligence | $7,000 per ounce | Next few years |

As we move past the pandemic, the factors affecting gold prices in 2025 will be key. They will shape investment strategies for both individuals and big investors.

“Gold could potentially triple in value over the next 6 years, reaching up to Rs. 200000.”

Mining Industry Trends and Supply Dynamics

As we look ahead, understanding the trends and dynamics in the mining industry is key. The supply of gold will greatly affect its future prices.

The mining industry is under more scrutiny for its environmental and ethical actions. [https://unnrc.com/news/battle-for-america-assessing-the-impact-of-jeo-bidens-usa-vs-trumps-administration/] Now, mining gold in a sustainable and responsible way is a top priority. This means stricter rules and more demand for gold that is ethically sourced. This could lead to higher prices for gold that is mined responsibly.

Gold is also in high demand for technology and renewable energy. This demand is expected to grow, affecting the gold supply dynamics. The mining industry must adapt to this new demand while following changing rules and what consumers want.

| Year | Gold Price (USD per ounce) |

|---|---|

| 2014 | $1,200 |

| 2019 | $1,500 |

| 2024 | $2,341 |

| 2025 (Forecast) | $2,600 |

The future of gold prices will depend on mining industry trends and gold supply dynamics. If mining is done responsibly and there’s a strong demand, we could see a gold price boom in 2025 and later.

“The mining industry is at a crossroads, where environmental and social considerations are becoming just as important as economic factors in shaping the future of gold supply.”

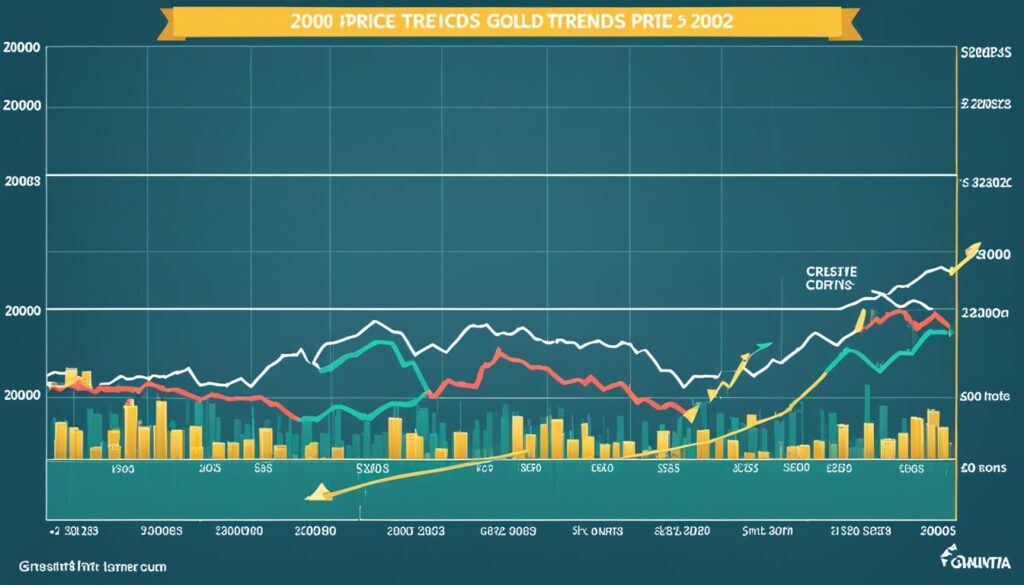

Historical Gold Price Analysis and Market Speculation

Gold has a long history as a valuable commodity. Its price has changed a lot over the years. From the gold standard to the Bretton Woods Accord, gold’s price has seen big changes. These changes show how the gold market is always moving.

Major Price Milestones and Catalysts

In 1980, gold hit a record high of $850 per ounce. This was due to global economic issues and high inflation at the time. Global economic instability and high inflation were big factors.

Before that, gold’s all-time high was $2,000 per ounce in 2008. This was during the financial crisis, when people looked for safe investments. Recently, gold hit over $2,000 per ounce in December 2023. This was due to market speculation and economic, geopolitical, and monetary policy changes.

Experts keep an eye on gold’s price movements. They use tools like moving averages and technical analysis to guess future trends. Economic forecasts pointing to a future slowdown often lead to higher gold prices. This is because investors look for safe assets, affecting gold prices in India.

- Gold prices went up during the 2008 financial crisis and again during the COVID-19 pandemic. These events show how past trends affect future predictions.

- Tools like the 50-day and 200-day moving averages help predict gold prices through technical analysis.

- Government policies on import duties can change gold prices. Higher duties make gold pricier, lowering demand, and vice versa, affecting gold prices in India.

As the gold market changes, experts and investors will watch its trends and factors. They’ll keep an eye on what affects gold prices in India and worldwide.

“It is anticipated that a short squeeze could lead to much higher gold prices by 2025 and beyond.”

Conclusion

The gold price is set to rise in 2025 due to economic, geopolitical, and market factors. These factors include economic recovery, inflation, central bank policies, and investor demand for safe assets. This mix points to higher gold prices ahead.

Despite risks and uncertainties, the gold market looks promising. It could hit new highs in the next few years. This makes the outlook for gold investors quite positive.

By 2024, the price of 10-gram 999 gold is expected to hit Rs 74,000, says the India Bullion and Jewellers Association (IBJA). This is a huge jump from 2015 and 2006 levels. Experts believe gold prices may keep climbing, possibly reaching Rs 2 lakh in 7 to 12 years.

Gold is key for protecting against inflation, market volatility, and geopolitical risks. It’s a must-have for a diverse investment portfolio. As gold prices are set to boom in 2025, investors should keep an eye on the market. They should also consider the benefits and risks of investing in gold.